Ensuring that you’re on a secure site is as simple as ensuring that the ‘s’ is present in the http of the website address. You should also see a closed lock symbol on the address bar of your browser.

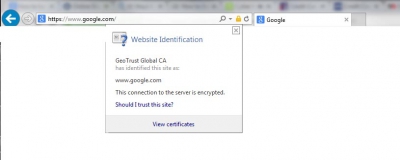

Internet Explorer

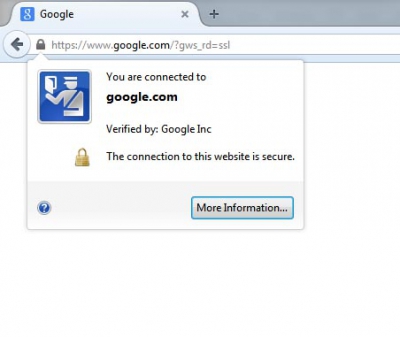

Firefox

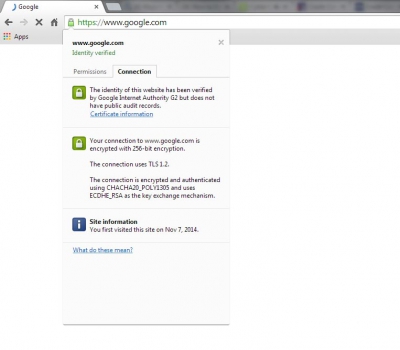

Chrome

As you can see in each of the screenshots, there is a closed lock symbol present in the address bar. The menu showing below the closed lock appears when you click on the closed lock, and provides you with information about the connect to that website. Each browser shows you that your connection is encrypted, though Chrome shows you considerably more information than the other two browsers.

No matter what browser you use, you should be able to quickly and easily tell the site you’re using is secured by seeing the https:// in the address bar, as well as seeing the closed lock symbol that will be present. If you’re ever not sure, click on the closed lock and verify that your connection is encrypted.

If you’re shopping from a mobile device, you can still use secure sites. Depending on the device, it may be more difficult to tell if the site is secure, though. Mobile devices often utilize shortened URLs that are more phone-friendly; this can lead to being tricked into visiting a site that is not legitimate. When shopping from mobile devices, always be sure to take extra caution.

Use Smart Payment Options

Shopping online should limit your payment options. Do not ever order something that you need to mail cash to pay for. Legitimate online orders will require immediate payment. While some merchants may allow you to pay with a check, this is the least secure option available to you. Many banks provide protection to you if your bank account is compromised, but you may still be held accountable for purchases made with your bank information. If you pay for an item online using your full bank account information (ie, an electronic check), and that information is stolen, you will have to close the account and open a new account to ensure future purchases are not made without your consent.

Using your debit card to shop online has the same pitfall as using a check electronically - if your information is stolen, the thief will have access to your bank account. This may or may not be a hassle, depending on your bank’s policies, but at the very least you will have to replace your debit card. It could be anywhere from a few days to a few weeks before your new debit card arrives, leaving you with only cash (withdrawn in person, not from an ATM) and checks to use in the meantime.

Using a credit card is your safest option when shopping online. Many credit cards will not hold you accountable for any purchases made without your authorization. If you are accountable, credit cards often have a limit on the amount you are liable for. Be sure you find out your credit cards’ policies in regards to unauthorized purchases, and ensure you use only the cards that provide you the most protection.

Utilize a Virtual Credit Card Number

Many credit card providers, and some banks, offer the ability to create a virtual credit card number that allows you to shop online without using your real credit card number. This virtual number will expire within a set amount of time, limiting the potential for the number to be used without your consent. If your credit card or bank offers this option, this is a great way to protect yourself while shopping online.

Consider Using a Pre-Paid Credit Card

If your credit card or bank does not offer virtual credit card numbers, or you do not want have to get a new number whenever you’re ready to buy something, consider using a pre-paid credit card. You can buy, and load, these cards from most large chain discount retail stores (Walmart, Target, K-Mart, etc.) and most large grocery stores. You will need to use cash or your debit card to purchase one of these. Most stores will not allow you to purchase one of these cards using a credit card.

One major drawback to using a pre-paid credit card is that you have no protection against loss. Even if the protection is slim, most banks do offer some sort of protection if your information is stolen. If you want to avoid that headache altogether, though, pre-paid credit cards are the way to go. If your card is lost or your information stolen, the hacker will only have access to the funds that are already loaded onto the card - they will have no way to access your other credit cards or bank accounts.

Only Shop From Protected Devices

This doesn’t mean you should hide your screen from prying eyes while you shop. What this means is ensure that the device you’re shopping from has antivirus and firewall protection, to ensure that the device is spyware, malware, and virus free. Because of the increase in protection from the merchant’s end, ensuring that your personal information is safe, malware and viruses are a highly utilized method of stealing personal information.

This also means to be careful about shopping from a mobile device. Smartphones and tablets do not have the same ability to run antivirus and firewall software that computers do. This means they are more vulnerable to malware and viruses that can capture your credit card or bank account information without your knowledge.

Avoid Public WiFi

Public WiFi is the least secure, and therefore, most dangerous, way to connect to the internet. Public WiFi spots are regularly targeted by hackers who want to gather personal or financial information from WiFi users. Very few WiFi spots use encrypted connections, and even when they do, the password is available to any patron of the establishment.

If it is necessary to send sensitive information via public WiFi, the best way to protect yourself is by utilizing a VPN. This ensures that your data is securely encrypted, even over the WiFi connection. If you missed my recent blog, check it out now: How A VPN Can Keep You Safe.

If you’re shopping from your mobile device, even if you didn’t actively connect to WiFi, ensure that your device is not automatically connecting to a nearby WiFi connection. Mobile devices are just as vulnerable over public WiFi connections as a computer is.

Turn Off Your Device When You’re Done Shopping

Most people leave their computer turned on, and therefore connected to the internet, at all times, even overnight. While this is not a problem for the computer, this can leave you more vulnerable when you’ve entered your personal information into a website. Beside cached information, your browser often remembers things you’ve done online, at least until the cache is cleared. This is most efficiently done by shutting down your computer. Turning your computer off also limits the time available to someone trying to hack your computer. Simply denying a hacker the time needed to gain access to your information can be enough to protect your financial information.

Strangers online are not the only source of identity theft. If you have children, roommates, or have guests in your home, you may find that someone physically accessed your computer and makes purchases with your information - either from your computer or with the information gathered from your computer. Turning off your computer when you’re not using it ensures that someone else cannot easily access your computer and personal information.

Dealing With the Aftermath of Identity Theft

If you do find your information is stolen, you contact all your credit card companies and bank accounts and notify them immediately. Ensure your computer is virus and malware free, then change all your passwords for all of your accounts.

And, of course, if you find that virus, malware, or malicious activity causes you to lose data, don’t forget to call Info Recovery. While we may not be able to help you if you’re a victim of identity theft, we can certainly help you recover data you may have lost due to the virus or malware that allowed the thief access to your information.